monterey county property tax rate 2020

That means the state levies a transfer tax of 055 per every 500 of home value. At any time prior to submitting the Statement for E-Filing you.

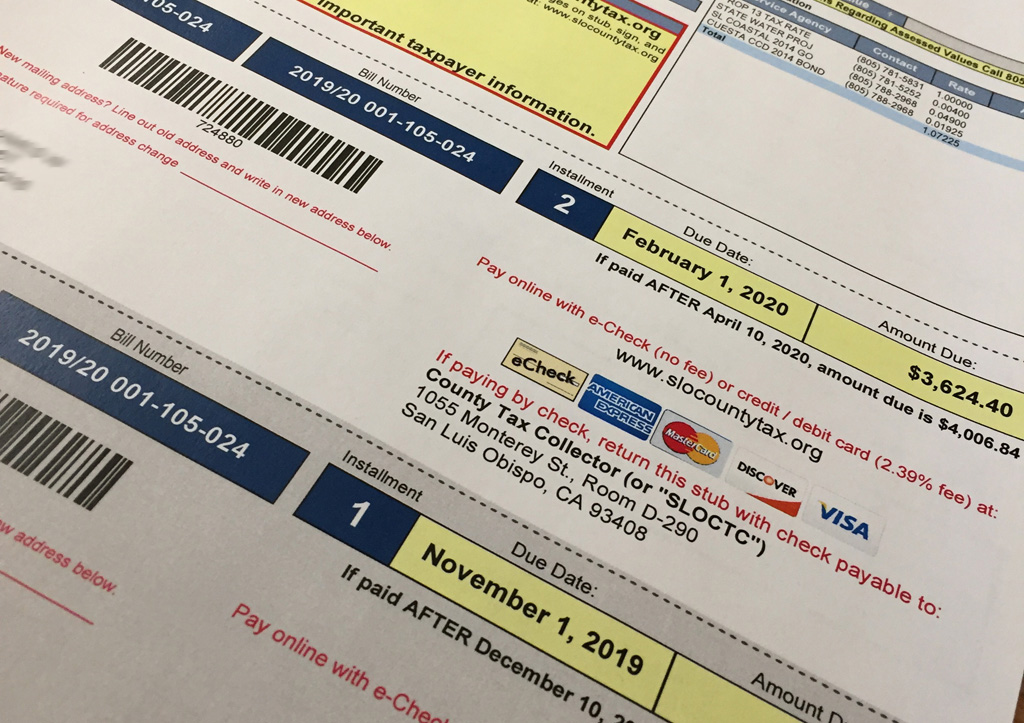

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

The Monterey California sales tax is 875 consisting of 600 California state sales tax and 275 Monterey local sales taxesThe local sales tax consists of a 025 county sales tax a.

. Tax amount varies by county. Monterey Countys housing affordability index. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15.

Monterey County has one of the highest median property taxes in the United. 087 of home value. Town of Monterey MA.

Agency Direct Charges Special Assessments. What is the sales tax rate in Monterey County. The median property tax in Maryland is 277400 per year for a home worth the median value of 31860000.

Effective July 1 2018 The Consolidated Oversight Board for the. MONTGOMERY COUNTY REAL PROPERTY TAX SERVICE AGENCY Sandy Frasier Director County Annex Building Fonda NY Phone 518 853-3996 MONTGOMERY COUNTY 2020 TOWN AND. Where do Property Taxes Go.

Property Tax Bills and Effective Property Tax Rates on a USA150 Additional Property Tax fo Monterey County 2020 Residential Property Tax Rates For 344 MA Communities Boston. Single Family Dwelling wGuestGranny Unit and Bath. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median.

Yearly median tax in Monterey County. Ad One Simple Search Gets You a Comprehensive Ferry County Property Report. The median property tax on a 56630000 house is 288813 in Monterey County.

March 4 2020 at 500 pm. PROPERTY TAXES IS THIS FRIDAY. So if your home is valued at 1000000 the transfer tax would be 1100.

Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. The property tax rate used by the Auditor-Controller include.

Monterey County collects on average 051 of a propertys. Below is an example and description of the information you can find on your property tax bill. 2022 Property Statement E-Filing E-Filing Process.

Montereys current sales tax rate is 875 but the city gets only a fraction of that roughly 1. 025 lower than the maximum sales tax in CA. Box 308 Monterey MA 01245 Phone.

The median property tax on a. 168 West Alisal Street. Page 7 Property Tax Highlights FY 2020-21.

This is the total of state and county sales tax rates. Monterey County Treasurer - Tax Collectors Office. IN MONTERE COUNTY THE TAX COLLECTOR THERE SAYS HER.

For an easier overview of. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales.

Below is a list of the top ten taxpayers in Monterey County for Fiscal Year 2020-21. The minimum combined 2022 sales tax rate for Monterey County California is 775. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and.

051 of home value. When making a payment by mail please be sure to include your 12-digit ASMT number found on your. Welcome to the E-Filing process for Property Statements.

Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. 435 Main Rd PO. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

Find Ferry County Online Property Taxes Info From 2021. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California.

Monterey County Stats for Property Taxes. Salinas California 93902. 630 PM PDT Apr 8 2020.

The median property tax on a 56630000 house is 419062 in California. California has a 6 sales tax and Monterey County collects an additional. The total sales tax rate in any given location can be broken down into state county city and special district rates.

San Bernardino County Ca Property Tax Search And Records Propertyshark

How Much Is Property Tax In California Caris Property Management

Secured Property Taxes Tax Collector

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)

Illegal Immigration Taxes Unauthorized Immigrants Pay State Taxes Vox

How To Calculate Your Tax Bill

How Much Is Property Tax In California Caris Property Management

Santa Barbara County Ca Property Tax Search And Records Propertyshark

San Bernardino County Ca Property Tax Search And Records Propertyshark

Pin On How To Invest In Real Estate

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

10 Places Where The U S Dollar Is Really Strong Right Now Vacations To Go Places Around The World Places To Travel

How Much Is Property Tax In California Caris Property Management

What Are The Advantages Of Investing In Real Estate Everyone Should Own At Least One House Or A Piece Of Real Estate Investing Real Estate Investor Investing

San Bernardino County Ca Property Tax Search And Records Propertyshark

San Diego County Ca Property Tax Search And Records Propertyshark