how are rsus taxed in california

However its still important to understand and manage it appropriately. If you then hold the vested shares for over one year before selling them then any additional gains would be then be taxed at the long-term capital gains rate.

Drs Financial Partners Home Facebook

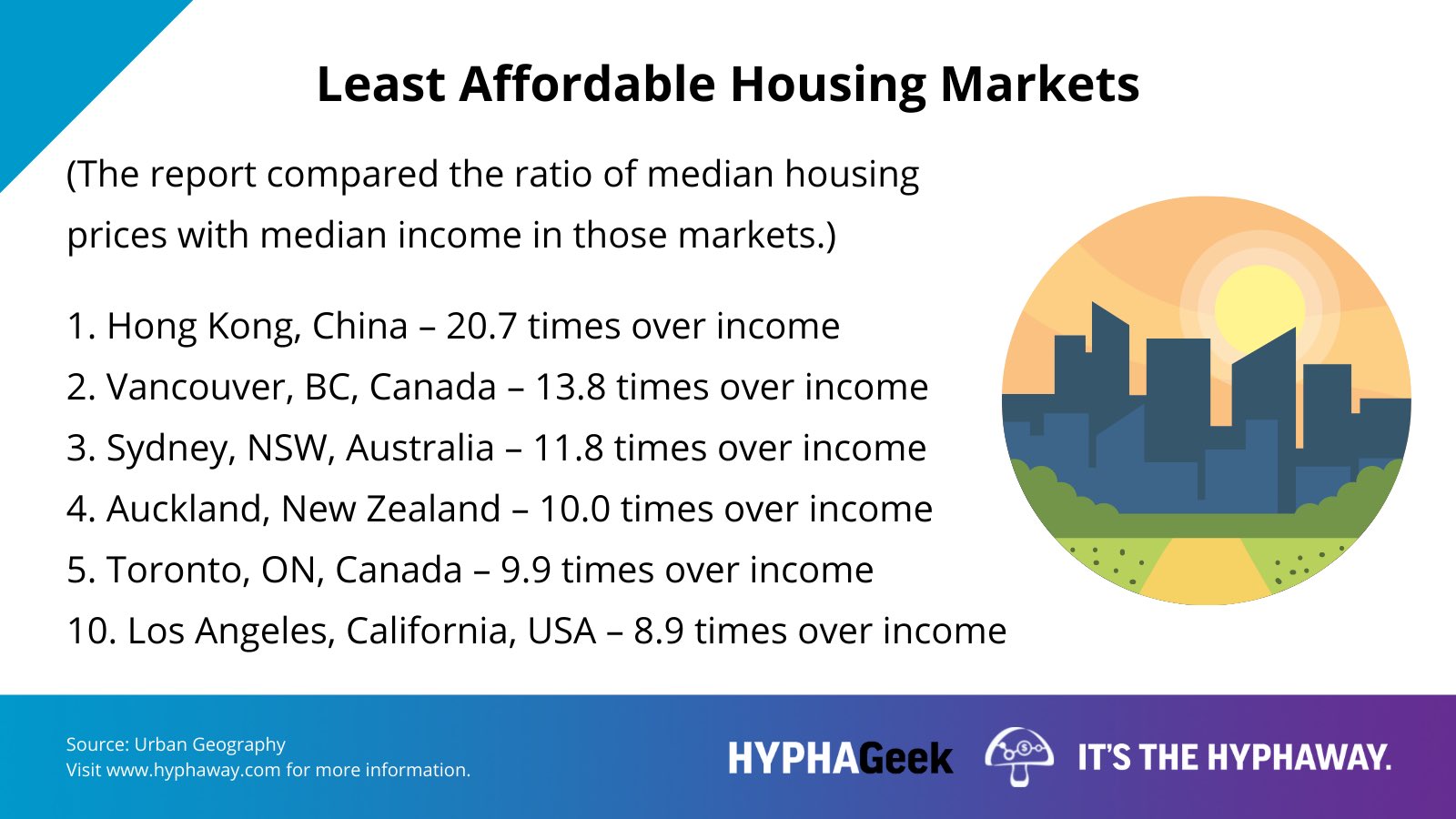

With RSUs you are taxed when the shares vest not when theyre granted.

. The 22 doesnt include state income Social Security and Medicare tax withholding. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Taxes at RSU Vesting When You Take Ownership of Stock Grants.

As the RSUs vest the value is taxed as income. The new company is based out of california as well. Nonresident of California on Vesting Date.

You have compensation income subject to federal and employment tax Social Security and Medicare and any state and local tax. The value of over 1 million will be taxed at 37. Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250.

I have a friend who lives in California. For RSUs you only have to pay tax once they vest into the RSUs. Taxation of RSUs.

Now she says that if she signs the offer letter in California then no matter. Your taxable income is based on the value of the shares at vesting. With RSUs you are taxed when the shares are delivered which is almost always at vesting.

The taxable income incurred on each vest is calculated as follows. Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward. 1 day agoRSUs have no effect on a tax account in all instances.

Lets start with how taxes on Restricted Stock Units typically work. How are rsus taxed in california Friday March 4 2022 Edit. Theyre taxed as ordinary income - so its based on your marginal tax bracket.

Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year vesting schedule. In some states such as California the total tax withholding on your RSU is around 40. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

Originally reporting the full value of the RSUs on his California nonresident return the taxpayer subsequently filed an amended return and claimed a refund based on the stock price when he left California. In other words if the stock increase in value after youve paid ordinary income tax. Restricted stock units RSUs are becoming a more common type of equity compensation for California employees.

100 shares vest at 10share. It is unlikely that your shares will be allocated until you pay the tax ie. RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest.

RSUs are taxed as income to you when they vest. If you are a nonresident of California on the date the stock vests the character of the income attributable to the vesting is compensation for services rendered. If you sell your shares immediately there is no capital gain tax and the only tax you owe is on the income.

Theres a second set of taxes. Its important to understand the amount withheld on future RSUs to avoid hefty tax charges afterward or even penalties. This doesnt include state income Social Security or Medicare tax withholding.

At the time that these RSUs are received by the taxpayer part of them are actually sold to offset the tax withholdings and some tax withholdings are paid using the proceeds. California will tax the income to the extent you performed services in this state. The amount after withholding taxes is the equivalent to the net amount.

The RSUs all vested in 2012 two years after the taxpayer became a California nonresident after moving abroad. RSUs are generally taxable like salary when shares vest. RSU Wage Income of shares vesting x share price on date of vest This is standard for the IRS but what about from a state perspective.

Your taxable income is the market value of the shares at vesting. In all states RSUs are taxed as regular income based on value at time of vesting. Lets say the TC is 200k and RSUs are 400k4 years.

Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. The UK tax system is similar to how your salary is taxed. In states like California where there is a state tax on earned income part of the shares is sold for federal withholdings and part is sold as state withholdings.

To ensure that employees pay the required income tax some companies take the taxes out for the employees by taking back a portion of the RSU grant. The Ultimate Guide To Getting Divorced In California Survive Divorce The World S 100 Trillion Question Why Is Inflation So Low Trillion The 100 Big Picture Advanced Paycheck. She wants to get a new job.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. Once when you take ownership of the shares usually when they vest and again in another way when you actually sell the shares. RSUs are taxed under federal income tax rules based on the market value of the RSU when the shares are delivered to the employee almost always at vesting.

How are RSUs Taxed. The short answer to your question is that the RSUs are taxed at vest and upon sale of the resulting shares. RSUs and Taxes.

Because there is no actual stock issued at grant no Section 83 b election is permitted. At vesting date California taxes the portion of the income from RSUs that corresponds to the amount of time you lived in. Other California State Tax Credits to be Aware Of That Will Save You Headaches Money Almost all income tax rules have the avoidance of double-taxation built in.

Instead of getting the stock immediately they receive it according to the terms of a vesting plan and distribution schedule after remaining with the company for a certain amount of time or achieving performance milestones. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. If your marginal federal income tax bracket is higher than 22 excluding.

Upon sale of the resulting shares. This compensation income is subject to federal taxes state taxes and payroll taxes Social Security Medicare. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income.

So for example even though you have to pay tax to California AND your new state the same income cant be taxed by both states at the same time thats just unfair. RSUs generate taxes at a couple of different milestones. For people working in California the total tax withholding on your RSUs are actually around 40.

The IRS and California FTB measures your RSU income as each tranche vests. Your taxable income is 1000. Services Performed Within and Outside California.

That income is subject to mandatory supplemental wage withholding. You have to pay taxes as soon as the. Because tax laws differ across states it all depends.

Nvidia Salary Negotiation Advice Based On Dozens Of Negotiations

The Mystockoptions Blog Tax Planning

How Are Stock Options Taxed Carta Singapore

Rsus In A Ceo Compensation Package Atty Robert Adelson

A Financial Planner Explains Why The Taxes On Restricted Stock Units Are So High

What Impact Does Equity Compensation Have On Your Divorce

What Are Restricted Stock Units Ellevest

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Mystockoptions Blog Tax Planning

Rsus In A Ceo Compensation Package Atty Robert Adelson

How Much Is 100 Worth In Your State

The Dreaded Underpayment Penalty How To Avoid It Kb Financial

If I Receive An Rsu Grant In Ca But It Vests When I Am A Resident Of Wa Do I Owe Ca Taxes When The Grant Vests Quora

Restricted Stock Units Driven Wealth Management San Diego Certified Financial Planner

/shutterstock_263186492-5bfc2b3246e0fb005144cda3.jpg)